UPI (Unified Payments Interface) allows individuals and companies to send and accept payments digitally. It eliminates third-party costs, making money transfers quick and safe. Here is our list of India’s 15 best Upi apps; all are free.

This list includes top UPI apps from reputable banks like State Bank of India, HDFC Bank, and Axis Bank to practical digital wallets like Paytm & Google Pay, used by millions of people all over India,

15 Best Upi Apps in India

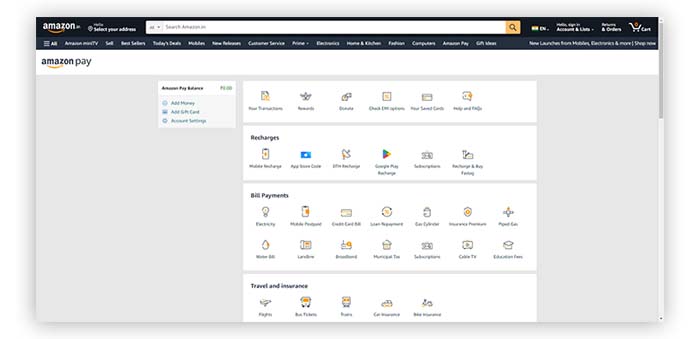

1. Amazon Pay

The launch of the Amazon Pay UPI app is one example of how Amazon has kept up with the growth of digital payments. Customers can complete transactions using the user-friendly app by connecting bank accounts to the app.

Amazon Pay also sends notifications that let users keep track of their transactions and get cash back and discounts for various purchases they make using the app. With all these capabilities, the Amazon Pay UPI app is unquestionably one of the greatest digital wallets on the market.

2. Google Pay

A Google-based payment app that elevates the money transmission process. You can send or receive money through its speedy and safe transactions in seconds. You can buy online, pay bills, send money to loved ones, and do much more using Google Pay; it also provides exciting cashback and scratch card offers.

Being the most secure platform, you can trust Google Pay for all your online transactions. Experience how simple and convenient it is to manage your money while on the road by downloading the app immediately.

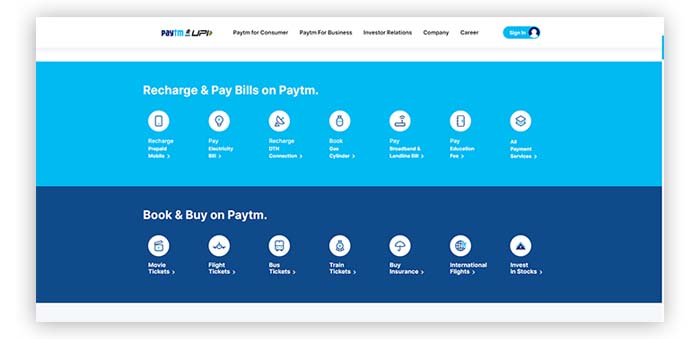

3. Paytm

Paytm elevates online money transmission. That’s it is among the best UPI apps in India. In a couple of seconds, you may send or receive money. You can do much more using the Paytm app, from booking movie tickets, railway tickets, D2H recharge, metro card recharge, and mobile recharge in just a fraction of the time. You can use Paytm for online transactions with ease.

4. Bhim

Bhim UPI will be a great option if you seek a trustworthy and effective app for online transactions. Users can quickly transfer money between banks and make payments using Bhim UPI by tapping a few buttons on their mobile devices.

The app is a great substitute for conventional payment methods and is widely recognized by retailers nationwide. It’s practical and safe, with several security processes and layers of safety encryption.

For everyone who values speed, effectiveness, and security, the Bhim payment app is a must-have app whether you’re transferring money to relatives or paying for products and services.

5. Freecharge

The Freecharge payment app has become a well-liked option among Indian customers due to the growth of digital payments and the demand for contactless transactions. Users can rapidly transfer money, pay bills, and top up their phones with only a few clicks. With its user-friendly design and features, the Freecharge has helped millions of users nationwide use it for their everyday bill payments.

6. Mobikwik

Mobikwik has gained popularity as a payment app due to its simple design and ease of use. Users are using this app because of its easy-to-use interface, and it offers features like fast transfers and a reward program. Customers can trust Mobikwik will keep their information and transactions secure because they emphasize security. They also offer mutual funds through their platform.

7. Phonepe

Phonepe is one of the most popular apps for upi transactions. Millions of Indians use Phonepe for bill payments, money transfers, and bank transfers. Their offer a user-friendly interface and sophisticated security system.

Phonepe has simplified and streamlined online transactions, whether placing a meal order or calling a cab. The program also provides fantastic cashback and discounts, which makes it much more alluring for users. Money management is now simpler than ever, thanks to Phonepe.

8. Airtel Thanks

Airtel Thanks offers great incentives, cashback opportunities, and an online transaction facility. You can pay your electricity, water, gas, and other bills from the convenience of your home with only a few clicks. Additionally, the app enables money transfers to users on the same platform or bank accounts. They offer cashback on completing transactions through their app.

9. Whatsapp Pay

Convenience is crucial when handling our accounts in the digital era. You can pay for items or services, divide bills with pals, or even transfer money to family members abroad with WhatsApp Pay. The service is safe and encrypted as an extra benefit, providing users confidence that their transactions are secure.

Whatapp Pay will be a reliable and easy online transaction option as most of us have already installed WhatsApp; it will save us effort and make payments through Whatsapp Pay.

10. Hdfc Payz

Users can conveniently pay their bills using HDFC Payz, including gas, electricity, and mobile recharge payments. HDFC Payz assures consumers that their financial information is protected by providing a highly secure transactional activity platform.

Users can make payments easily with HDFC Payz, which offers rewards and discounts and makes transactions more interesting. HDFC Payz’s popularity is increasing daily, and that’s why people are taking advantage of the various benefits it provides.

11. Jio Pay

Jio Pay UPI is an app that can potentially dominate the Indian market due to its easy-to-use, rapid, and smooth payment procedure. With just a few clicks on your phone, Jio Pay lets you send and receive money for groceries and energy bills or even share the cost with pals.

Jio Pay UPI offers simplicity of use without sacrificing your privacy because of its security system to safeguard your personal information. Jio Pay UPI is the ideal app for all your payment requirements, whether at home or out and about.

12. Jupiter Money

By developing a simple, user-friendly, and customized platform, they are offering a substitute for the conventional transaction system. With an emphasis on openness, ease of use, and customization, Jupiter is attacking the flaws of conventional online transactions.

They’ve also created a fun rewards program for their clients that is both distinctive and novel. Banking can be smooth, easy, and even pleasant using Jupiter.

13. Oxigen

We all have busy lives, so anything that helps make our daily tasks simpler is much appreciated. That is why apps like Oxigen have become so popular lately. With its user-friendly and secure platform, you can be confident that your transactions are secure and dependable. That is why many individuals would use this well-known app for online transactions.

14. Payzapp

With only a few clicks, you can send and receive money with Payzapp on your phone. You may use it to purchase airline tickets, pay bills, and recharge your phone. Say goodbye to searching your pockets for spare change or worrying about having enough cash. Your financial transactions are only a touch away with Payzapp.

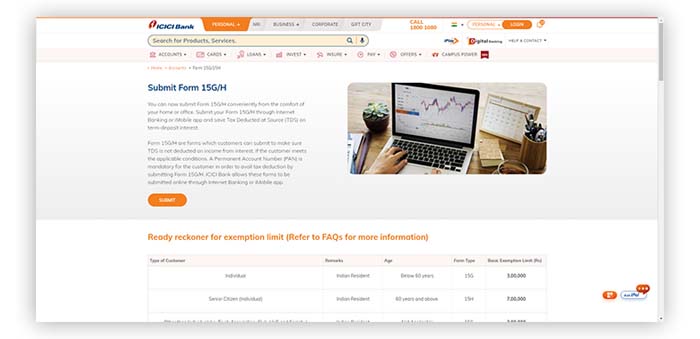

15. iMobile Pay by ICICI Bank

iMobile Pay by ICICI Bank is a safe and easy-to-use mobile payment app. With iMobile Pay, you can quickly and easily complete purchases. iMobile Pay provides exclusive discounts and cashback incentives, making it a wise and practical decision for regular purchases. With iMobile Pay by ICICI Bank, you can easily complete your online transactions.

Conclusion

Those were the 15 best UPI apps in India for digital payment. There is an app for everyone, whether you are sending money for personal, paying a business or loan. You can effortlessly manage all your online money transfers from anywhere and keep track of all your payments with the help of the apps on our list.

Properly read the terms and conditions before engaging in any financial transaction. And now that you are aware of some of the best UPI apps, it is time to take charge of your finances by using one of them right away!

Also Read: