It isn’t easy to finance education as a student; However, many loan apps offer different rates, terms, and conditions, so it becomes difficult to determine which one is best for you. Luckily, some great loan apps make your decision easier, giving you direct access to plenty of competitive loans with just a few swipes! In this blog post, we’ll explore some of the best loan apps for students to make informed decisions about financing their higher education.

10 Best Loan Apps for Students

1. mPokket

mPokket app provides the best personal loans with no physical documentation required. With a fast and easy process, you can access cash within minutes at a low-interest rate. Its borrowing limit increase when you use this app and repay on time. It allows you to say goodbye to stress and welcome financial freedom.

2. Slicepay

Slicepay is a refreshing alternative to traditional credit cards, offering a flexible and hassle-free payment solution for the modern-day student. With minimal documentation requirements and an easy-to-use mobile application, Slicepay eliminates the need for paperwork and long wait times.

It is a game-changer for students who want to stay financially responsible while still enjoying the benefits of credit. Join Slicepay to experience the freedom and flexibility of this next-generation loan solution.

3. KreditBee

Are you finding it hard to get a loan for your urgent needs? KreditBee can be a one-stop solution. KreditBee is a digital lending platform that provides fast and easy student loans, even if you don’t have a credit history. KreditBee approves loans within minutes and disburses the amount to your account within 24 hours.

Moreover, KreditBee offers loans starting from as low as Rs. 1000 up to Rs. 2 lacs at a low interest rate. Whether a medical emergency or a personal expense, KreditBee is the right choice to get a quick loan directly to your bank account.

4. Dhani

With Dhani, you can do anything from the convenience of your home:

- Create a savings account.

- Ask for a loan.

- Invest in mutual funds or stocks, and even purchase insurance products.

Dhani stands out for its quick approval times and prompt financial transfers to your account.

You can get loan approval in just a few minutes. Dhani is the ideal platform for managing your funds effectively and efficiently, regardless of whether you are a student, professional, or company owner.

5. Sahukar

Sahukar offers quick and easy access to student loans with various repayment options. Plus, their secure and reliable platform keeps your personal information safe. Don’t let financial stress overwhelm you anymore. You need not waste your time and money on transportation to traditional loan providers; you can easily download the Sahukar app and apply for a loan.

6. KrazyBee

KrazyBee is a student loan app in India. With KrazyBee, you can easily apply for loans to cover everything from textbooks to laptops to living expenses. KrazyBee allows you to get a loan directly to your account within 2-3 days.

But that’s not all – KrazyBee also offers various other services, including online shopping, mobile recharges, and bill payments! So what are you waiting for? Download KrazyBee today and take control of your finances.

7. CashBean

When you want an immediate loan, CashBean is a lifesaver. Since the entire procedure is digital, you can apply for a loan from your home. Anyone needing financial help can consider CashBean because of its affordable interest rates and flexible repayment alternatives. You can easily get a loan without any hassle with the CashBean app.

8. Fibe

Fibe loan application offers college students a quick and easy method to apply for and receive loans directly from a mobile app.

Fibe offers a practical alternative for people needing emergency finances without the need for time-consuming paperwork or in-person bank visits.

The app also offers simple repayment alternatives that let customers settle their debts using the app.

The Fibe loan app can be the answer you’ve been seeking if you have unforeseen bills or need additional money.

9. IndiaLends

IndiaLends is a fintech business that offers credit to millions of Indians at reasonable rates.

IndiaLends has grown to be a well-liked option for those who need immediate access to cash thanks to its straightforward and efficient application process.

IndiaLends is positioned to lead the Indian fintech market as it diversifies its offerings.

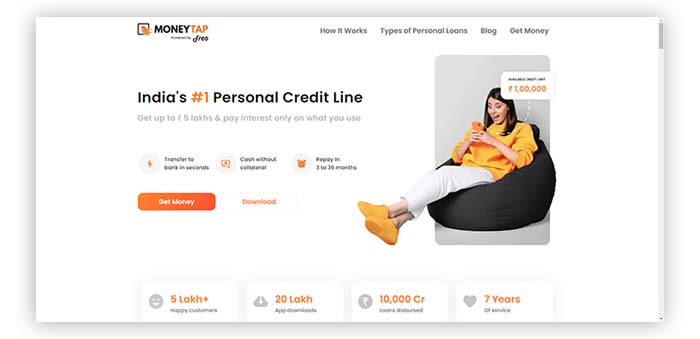

10. MoneyTap

MoneyTap is a personal loan platform that empowers individuals to achieve their financial goals without the stress of traditional banks. With its user-friendly app, flexible loan options, and fast approval process, MoneyTap makes access to credit easy and hassle-free.

Whether you need the funds for coaching or your class project, MoneyTap has got you covered with their quick and easy financial support.

Conclusion

This blog listed loan apps for students; ensure the loan you pick is compatible with your long-term objectives by thoroughly researching all available possibilities. Never take out a loan until you know all its terms and circumstances.

Investigate these student loan applications today to start on the road to smart borrowing. Make sure you choose the ideal one for your needs!

Also Read: